The Indian hotel industry is preparing to comply with the new GST taxation law set forth by the Government of India. To streamline your billing and reservation processes, your hotel must be GST-ready.

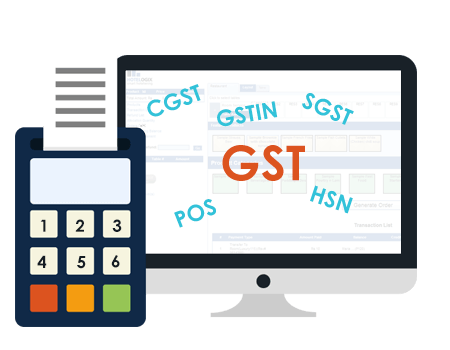

Goods and Service Tax - What is it?

According to the Government of India, GST is a single tax on the supply of goods and services right from the manufacturer to the consumer. GST proposes to create a single comprehensive tax structure for the whole nation that will subsume all the other smaller indirect taxes on consumption like service tax, luxury tax, vat, and so on.

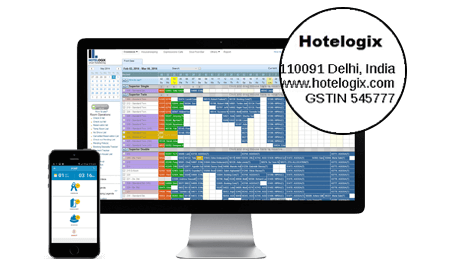

Request A Demo